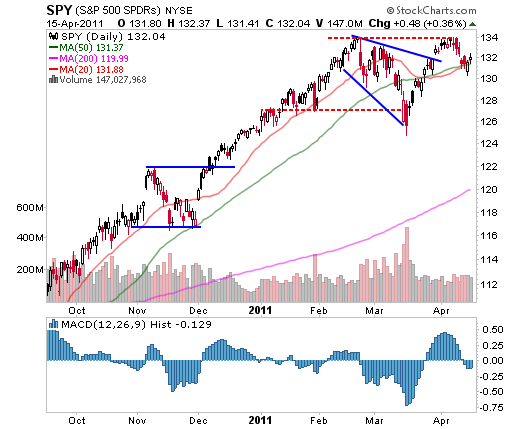

The Weekly Report For April 18th - April 22nd, 2011 Commentary: The markets closed down this week, although they did manage to finish well off their intraweek lows. Buyers stepped in on Thursday after most of the market index ETFs briefly breached some support levels. This sets the stage for another test of resistance levels just above those levels. The markets worked off some of the recent buying pressure and this week’s lows are now an important level to key off in the near term. Tutorial: Technical Analysis The S&P 500, as represented by the S&P 500 SPDRS (NYSE:SPY), briefly dipped under its 20- and 50-day moving averages this week, but managed to close the week back above these levels. The lows set this week are important to monitor as they may be the key to whether the recent pullback is merely at its midway point or, worse, is just getting started. Now that buyers have defended this area, the markets will likely attempt to breach the $134 level again and much will depend on what happens then. If the markets reverse back under this week’s lows, they could be headed back to test the lows set in March. |

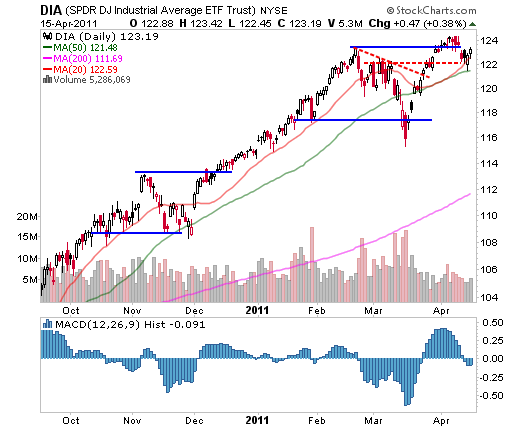

| | Source: StockCharts.com | The Diamonds Trust, Series 1 (NYSE:DIA) ETF managed to hold above its 50-day moving average and remains near an important level near $124. Much like SPY, this week's low will be critical to monitor moving forward. DIA may find itself trading in a narrow range between its recent highs and lows for the next few days. While it really could trade in either direction, the levels to watch are clearly defined and should be fairly straightforward to monitor. |

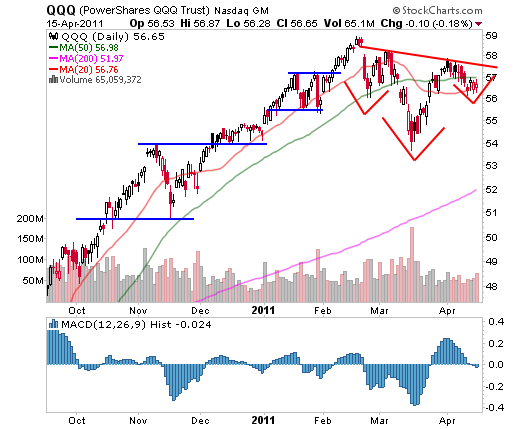

| | Source: StockCharts.com | The Powershares QQQ ETF (Nasdaq:QQQ) ETF is giving us a little more to chew on. QQQ has been lagging for a few weeks as its largest component, Apple (Nasdaq:AAPL), continues to decline. This week, Google (Nasdaq:GOOG) added to the problems for QQQ with an earnings miss that led to an 8%+ drop on Friday. With two of its largest components severely underperforming, it’s actually a little surprising to see that QQQ has managed to stave off a large decline. Stepping back, QQQ is starting to develop an inverse head-and-shoulders pattern that bears watching. This pattern typically ends a correction and a move above the declining trendline just above $57 certainly would be a positive development. |

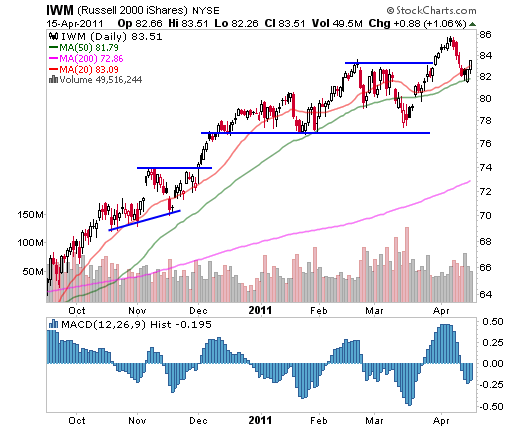

| | Source: StockCharts.com | The iShares Russell 2000 Index (NYSE:IWM) ETF also found support near its 50-day moving average, and while its decline has been greater than the other ETF’s, it remains technically sound. IWM did dip back under the top of its prior base, but remains above the majority of the recent trading action. This week’s lows are key for this ETF. A drop under the lows set under $82 would be very negative and would imply a trip back toward $77. |

| | Source: StockCharts.com | The Bottom Line

Earlier this week, the markets pushed lower as they became oversold. While the bounce was fairly predictable, what happens next is still up in the air. This week’s lows are now a very important barometer for the next market move. A continued consolidation above this level, coupled with a push higher, would likely lead to a breakout. A drop under this level would likely signal a move lower that is at least equal in size to the preceding pullback. With earnings season ramping up, reactions to the slew of reports will likely dictate the next direction, so traders need to stay on their toes.

Use the Investopedia Stock Simulator to trade the stocks mentioned in this stock analysis, risk free! |

0 komentar:

Posting Komentar